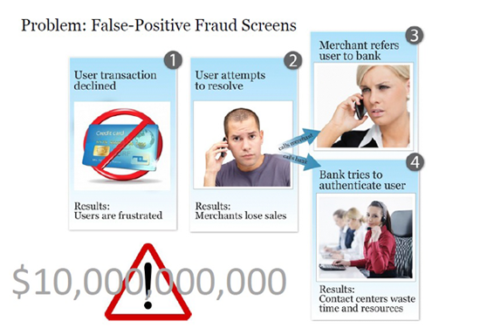

False positives

Financial institutions such as banks and credit card issuers have extensive systems in place to detect fraudulent transactions. However, consumers can often find themselves being screened out as fraudulent, even when they’re not.

Imagine a consumer who is traveling on business and places an order online for a new, fairly expensive computer for a presentation the next day. This customer doesn’t normally purchase large items and his address doesn’t verify, so he is flagged by the bank’s existing fraud detection systems. His order is declined, even though he is a legitimate customer who has now been left stranded. The merchant loses the customer and now the bank has to bear the overhead cost as the customer tries to unblock his card.

Every CFO knows about the high costs of fraud. Companies are always looking for new, more effective ways to validate customers without diminishing the brand experience their clients have.

Crowdsourced Mobile Authentication

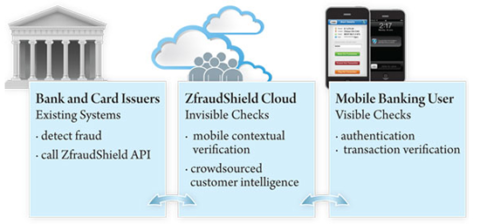

Zighra designed ZfraudShield to help reduce these false-positive fraud screens and their costly impact on contact centers, and to address the associated customer inconvenience and merchant dissatisfaction. ZfraudShield identifies and authenticates the purchaser and ensures they are the legitimate cardholder.We provide financial institutions with out-of-band, two-factor authentication to help with security, fraud prevention, and fraud and chargeback mitigation. We operate with the most advanced security and technological systems to stay one step ahead of hackers and fraudsters who try steal your money through fraud and security attacks.

Our mobile contextual checks, coupled with crowd-sourced customer knowledge, provide issuing banks and merchants with the necessary information to detect fraudulent orders before the payment is processed, and to allow legitimate orders to proceed. ZfraudShield does this by asking the consumer to authenticate and then verify the transaction on their mobile phone, thus closing the fraud loop in real time.

Benefits

Improve Experience

Our intuitive mobile app plugin allows customers to authenticate and verify suspicious transactions on their own mobile devices.

Reduce Costs

Our system reduces call center volumes, fraud losses, and fraudulent transactions, all while freeing up resources to focus on real fraudsters.

Simple Integration

Our simple cloud-based back-end API instantly plugs into your existing mobile banking app, and does not displace your current fraud management and detection systems.

SCHEDULE A DEMO

Want to learn more or take ZfraudShield for a test drive? Contact us